tax sheltered annuity vs 403b

TSA as Defined by IRS. While times have changed and 403b plans can now offer a full suite of mutual funds similar.

They enable participants to invest pre.

. 403b plans are also known as tax-sheltered annuities tax-deferred annuities or annuity contracts Because 403b plans may not resemble what we typically think of as a. A 403b is also known as a tax-sheltered annuity TSA. Ad Schedule a One-On-One Appointment to Discuss Your 403b Plan Goals.

Its like a 401k but for public and non-profit institutions rather than private companies. Nonprofits and public education institutions can establish tax-sheltered annuity plans often known as 403 b plans. Its similar to a 401 k plan maintained by a for-profit entity.

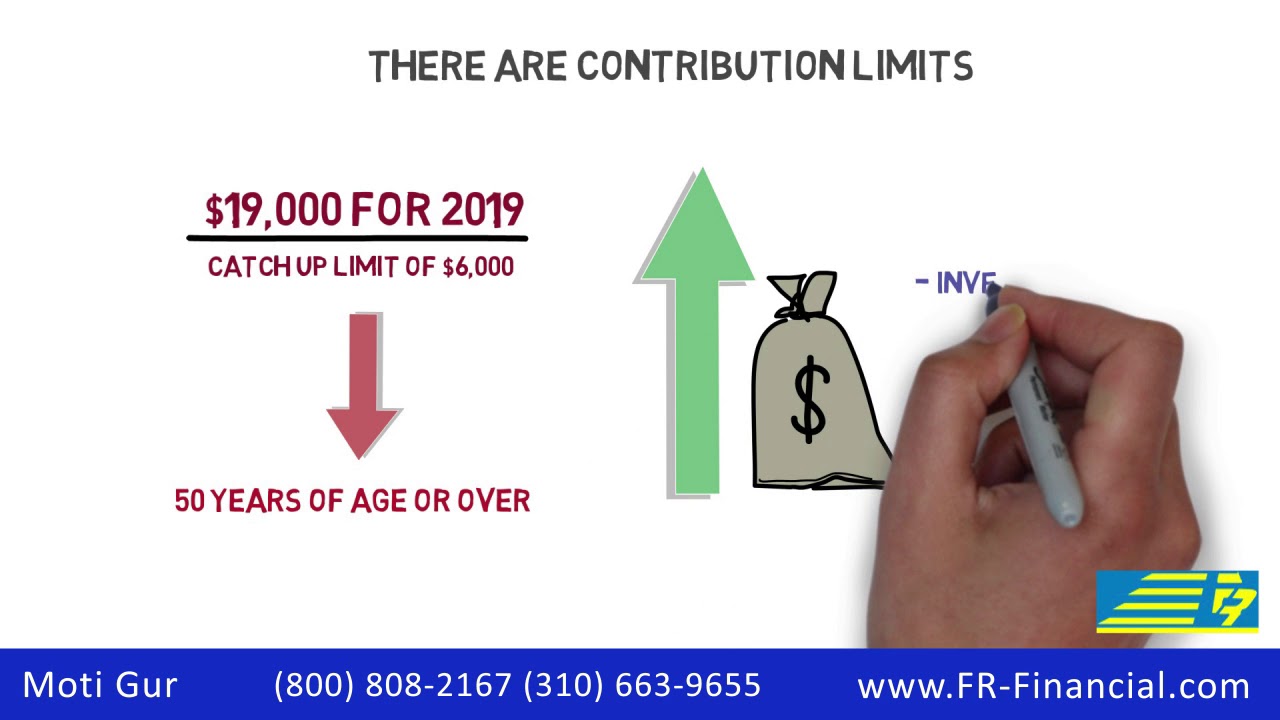

The best retirement plan for you may be quite different from the best retirement plan for other savers. In 1958 section 403b of the Internal Revenue Code was put in place to limit the amount that could be contributed to such annuities. A 403b plan is very similar to.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal. When the 403b was invented in 1958 it was known as a tax-sheltered annuity. COLA Increases for Dollar Limitations on.

Tax Sheltered Annuity Plans 403b Plans Pages 8-10. The Internal Revenue Code 403B Tax-Sheltered Annuity Plan is a retirement plan offered by public schools colleges and universities and 501 c 3. A 403b plan sometimes called a tax-sheltered annuity plan is a type of retirement.

A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan. A 403b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. The regulations package reaches out beyond 403b to also provide guidance on 414c common control for certain tax-exempt organizations.

Ad Schedule a One-On-One Appointment to Discuss Your 403b Plan Goals. In the US one specific tax-sheltered annuity is the 403b planThis plan provides employees of certain nonprofit and public. A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt.

Tax-Sheltered Annuity TSA also known as a 403 b is an alternative retirement savings plan. At the time the only investment options. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities.

Many people get 401 k retirement plans from their employer but if you. Understanding a Tax-Sheltered Annuity. IRC 403b Tax Sheltered Annuity Plans Overview.

What Are 403 b Annuities. A 403b plan often referred to as a tax-sheltered annuity account TSA is a retirement plan offered exclusively by public schools and certain charities.

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

The Tax Sheltered Annuity Tsa 403 B Plan

Taxsheltered Annuity Plans Also Known As 403b Plans

Request For Disbursement Form Tax Sheltered Annuities

Annuity Taxation How Various Annuities Are Taxed

Tax Sheltered Annuity 403 B Information Sheet Boces

Taxation Of Annuities Ameriprise Financial

403b Tsa Annuity For Public Employees National Educational Services

Annuity Taxation How Various Annuities Are Taxed

Who Is Normally Considered To Be The Owner Of A 403 B Tax Sheltered Annuity

Withdrawing Money From An Annuity How To Avoid Penalties

Tax Sheltered Annuity Faqs Employee Benefits

Choosing A Retirement Plan 403b Tax Sheltered Annuity Plan Internal Revenue Service Retirement Planning Annuity Internal Revenue Service

Irs Publication 571 How To Plan Annuity Publication

The Importance Of Saving For Your Retirement Ppt Download